In keeping with Token Unlocks, a platform that tracks upcoming unlocking occasions, 56% of all of the OP token most provide is within the to-be-discussed (TBD) allocation, which means the neighborhood is but to vote and decide the place these tokens shall be assigned to within the coming weeks or months.

This information is a curious growth, particularly for OP Mainnet, the workforce behind one of the crucial widespread Ethereum layer-2 scaling options, and OP token holders.

Billions Of OP Not Assigned

Token Unlocks notes that roughly 2.4 billion OP, representing 55% of the max provide, stays beneath the TBD allocation. Thus far, over 831 million OP, or barely above 19% of the max provide, have been unlocked.

This revelation additionally comes when OP costs have been trending greater, breezing previous essential resistance ranges. At spot charges, OP is altering fingers above September and October highs, quickly retesting October highs. The bull bar of November 10 anchors the present leg up because it was accompanied by comparatively excessive buying and selling quantity.

Token Unlocks defines a TBD allocation as not assigned a launch timing however shall be topic to neighborhood voting. These tokens could be distributed for governance, Retroactive Public Items Funding (RetroGPF), ecosystem funding, moved to advisers or companions, and way more.

RetroGPF is a funding mechanism that enables the protocol to help initiatives constructing options on its general-purpose layer-2 platform. Since it’s retroactive, initiatives or builders don’t have to use for funding upfront.

Normally, token unlocking releases cash initially locked or vested for a given time. Initiatives are inclined to make use of this tactic to align the incentives of traders and that of the workforce. This additionally concurrently prevents early adopters from mass promoting the coin, driving costs decrease. Even so, since all specified unlocks are carried out publicly, transparency permits traders or merchants to make knowledgeable selections.

What Will Occur To OP Costs?

For the token’s Mainnet’s case, an enormous chunk of the max provide stays unassigned at spot charges, which is, as it’s, supportive of costs. Nevertheless, as soon as these tokens are voted for, and the neighborhood decides the portion of the utmost provide that may, as an example, be distributed to advisers or used to fund ecosystem initiatives, then there’s a tendency for costs to fall because the unlock date approaches.

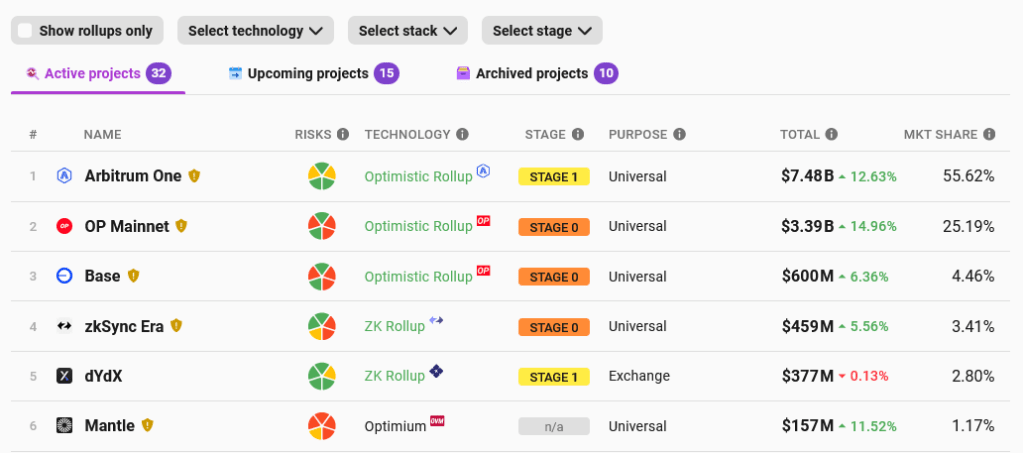

In keeping with L2Beat, OP Mainnet is the second largest layer-2 scaling answer for Ethereum after Arbitrum One. OP Mainnet has a complete worth locked (TVL) of $3.39 billion, commanding a market share of 25%. In the meantime, Base, a competitor backed by Coinbase, is third with a TVL of $600 million.

Characteristic picture from Canva, chart from TradingView

#Whooping #Max #Provide #Assigned