Discover the dynamics behind Bitcoin’s bullish run and the rising anticipation round a U.S.-based Bitcoin ETF. A deep dive into market traits and predictions.

Over the previous few days, Bitcoin (BTC) has demonstrated important resilience and progress, marking a noteworthy development within the cryptocurrency market.

Amid a surge in buying and selling quantity, BTC value reached its recent 52-week excessive of $37,926 on Nov.9. Nevertheless, amid the volatility, the value retraced and buying and selling at $37,100 as of Nov. 10.

This current rise is partly attributed to a “quick squeeze” – a market phenomenon the place the value of an asset jumps larger than anticipated, forcing quick sellers to cowl their positions, additional driving the value upward.

The ripple results of Bitcoin’s surge have been additionally felt within the U.S. inventory market, notably amongst crypto-centric corporations.

Shares of outstanding companies equivalent to Coinbase and MicroStrategy confirmed notable will increase, with Coinbase rising about 4% and MicroStrategy, holding over 150,000 BTC, rising virtually 5%.

Equally, mining companies Marathon and Riot additionally noticed substantial positive factors. This development displays rising optimism out there, particularly with the potential approval of a spot Bitcoin ETF within the U.S.

Let’s delve deeper into these current developments and attempt to gauge the place BTC is headed in the long term.

Components underpinning BTC bull market

Bitcoin’s spectacular surge, boasting a 123% year-to-date (YTD) achieve, presents a exceptional distinction towards turbulent macroeconomic situations and geopolitical tensions.

This efficiency has led to heightened market sentiment, with merchants more and more optimistic about Bitcoin’s value trajectory.

The choices market knowledge reveals merchants are positioning themselves for Bitcoin to succeed in the $40,000 degree. This type of bullish positioning within the choices market usually displays broader investor sentiment and may have a self-reinforcing impact available on the market.

In the meantime, the worry and greed index has reached a rating of 77, a degree similar to these seen when Bitcoin hit its all-time excessive in November 2021, indicating a big shift in investor sentiment.

Including gasoline to the fireplace, the potential approval of Bitcoin spot ETFs, together with these from main gamers like BlackRock, Constancy, ARK Make investments, and 21 Shares, has possible fueled investor optimism.

Whereas the SEC has but to approve a spot Bitcoin ETF, the open interval for approval extends till Jan. 10, 2023, sustaining a degree of anticipation out there.

Bitcoin on-chain metrics evaluation

Bitcoin’s on-chain knowledge gives beneficial insights into the community’s well being, utilization patterns, and potential future value actions. Let’s delve into these metrics:

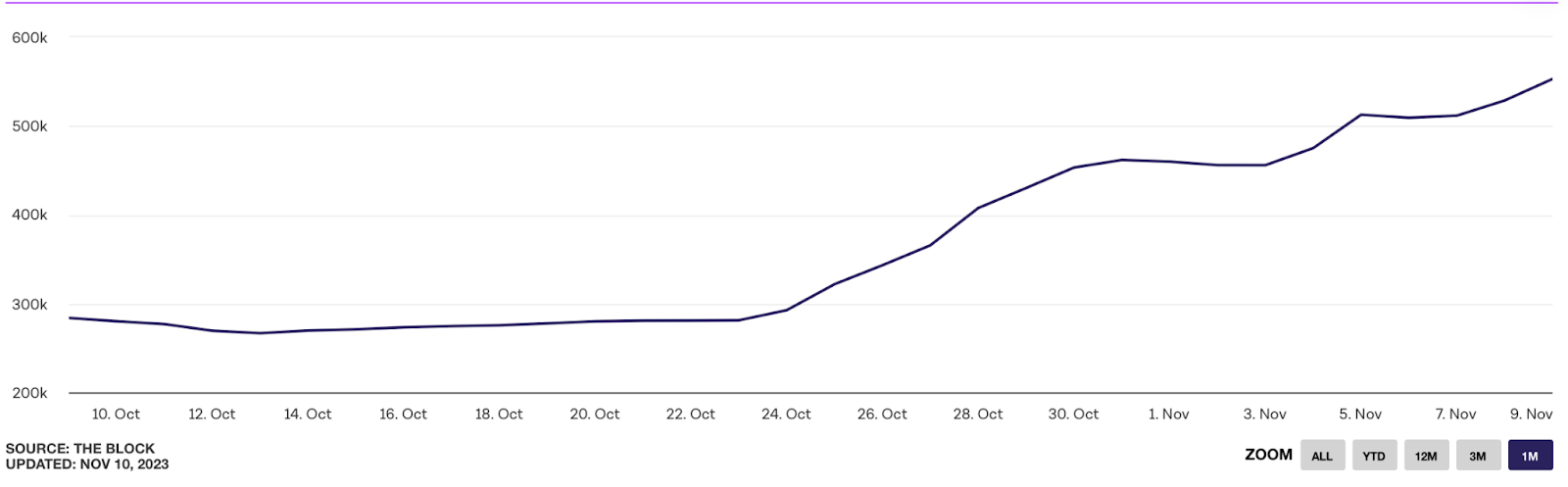

Every day transactions on the BTC community

This metric represents the whole variety of transactions processed on the Bitcoin community inside a 24-hour interval. It’s a direct indicator of the community’s utilization and exercise degree.

The numerous improve from 283,000 transactions on Oct. 9 to 553,000 on Nov. 10 signifies a heightened degree of exercise and engagement inside the Bitcoin community. This surge might be related to elevated investor curiosity, larger buying and selling volumes, and probably a rising adoption of Bitcoin for varied use instances.

Usually, a better variety of day by day transactions is seen positively, because it suggests sturdy community well being and generally is a bullish sign for Bitcoin’s value.

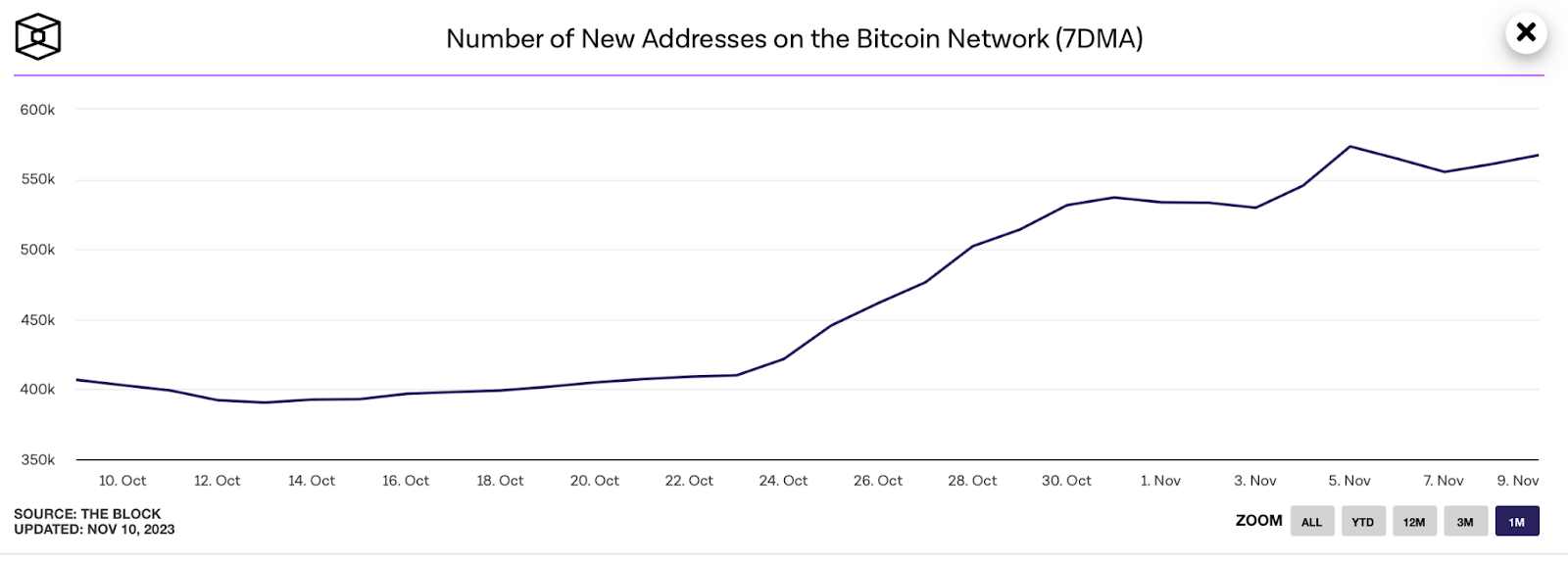

Variety of new addresses

This metric tracks the variety of new Bitcoin addresses created every day. New addresses can signify new customers coming into the community or present customers producing new addresses for transactions.

The rise from 406,000 new addresses on Oct. 9 to 568,000 on Nov. 10 displays rising participation within the Bitcoin community.

A rise in new addresses is a precursor to elevated demand for Bitcoin, which, in flip, can drive up its value. Nevertheless, it’s necessary to notice that not all new addresses signify new customers, as a single person can generate a number of addresses.

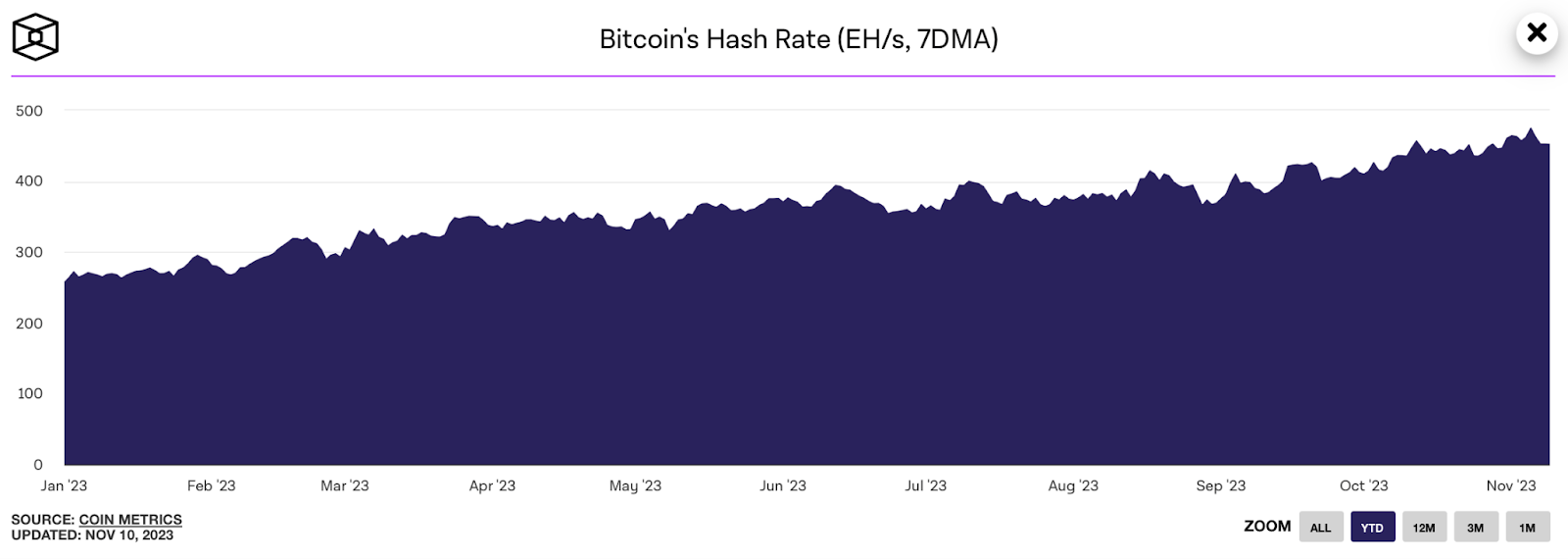

Bitcoin hash fee

The hash fee measures the whole computational energy used to mine and course of transactions on the Bitcoin community. It’s a key safety metric, indicating how a lot computing energy is required to hack or manipulate the community.

The leap in hash fee from 256 EH/s on Jan. 1 to 452.01 EH/s as of Nov. 10 is a powerful indicator of community safety and miner confidence.

The next hash fee implies extra miners are lively and investing sources, suggesting their perception in Bitcoin’s profitability and stability.

Usually, a rising hash fee is taken into account bullish for Bitcoin’s value because it denotes a safe and sturdy community enticing to each buyers and customers.

Bitcoin (BTC) value prediction

Stories recommend that an approval of a spot Bitcoin ETF may generate important new demand, probably resulting in a $1 trillion improve in Bitcoin’s market capitalization.

Galaxy Digital, a outstanding identify within the crypto area, predicts a 74% value improve in Bitcoin within the first 12 months following a spot BTC ETF launch. They used $26,920 as the bottom value, suggesting greater than half the rally has already been exhausted.

This expectation is predicated on the premise that an ETF would make Bitcoin accessible to a broader vary of buyers, notably these in conventional finance who’re extra comfy with regulated funding automobiles.

In the meantime, algorithmic fashions and Bitcoin forecast web sites are projecting optimistic progress for Bitcoin within the coming years.

In line with these Bitcoin value predictions, BTC is anticipated to succeed in round $74,195 in 2023 and improve additional to roughly $90,361 in 2024.

Whereas these BTC forecasts current an encouraging outlook, buyers are suggested to train warning and to not make investments greater than they will afford to lose.

Cryptocurrency markets, notably Bitcoin, are recognized for his or her volatility, and forecasts shouldn’t be the only foundation for funding choices.

Disclosure: This text doesn’t signify funding recommendation. The content material and supplies featured on this web page are for instructional functions solely.

#Bitcoins #excessive #alerts #main #market #shift #evaluation #predictions