Ethereum’s newest surge to over $2,098 indicators a bullish market development. What’s driving the value, and the way far will ETH go?

Ethereum (ETH), the second-largest digital asset by market capitalization, skilled a noteworthy surge on Nov. 9, reaching its 52-week excessive of $2,137.

As of this writing, Ethereum is effectively above the $2000 mark, buying and selling at roughly $2,098, marking a virtually 10% enhance inside a 24-hour interval.

Total, for the reason that starting of the yr, Ethereum has seen a powerful uptick, growing by greater than 75% yr thus far (YTD). Nevertheless, regardless of these positive factors, Ethereum continues to be significantly beneath its all-time excessive of $4,891 in November 2021.

Let’s delve deeper into Ethereum’s current worth motion, discover the underlying components driving this surge, and supply insights into the place Ethereum could possibly be headed within the coming days.

Why the ETH worth is up

The current surge in Ethereum’s worth could be attributed to a mixture of things. One of many vital triggers for Ethereum’s worth enhance on Nov. 9 was BlackRock‘s registration of an iShares Ethereum Belief in Delaware.

Trade observers consider that Blackrock is making ready to launch a spot Ethereum exchange-traded fund (ETF) following the potential approval of its spot Bitcoin ETF proposal.

Blackrock utilized for a spot Bitcoin ETF on June 15, 2023, and is now awaiting a verdict from the SEC.

Bloomberg Intelligence analysts have indicated that the U.S. Securities and Change Fee (SEC) would possibly quickly determine on the approval of 12 Bitcoin ETFs filed by main Wall Road companies, which has contributed to the bullish sentiment within the crypto market.

ETH on-chain metrics

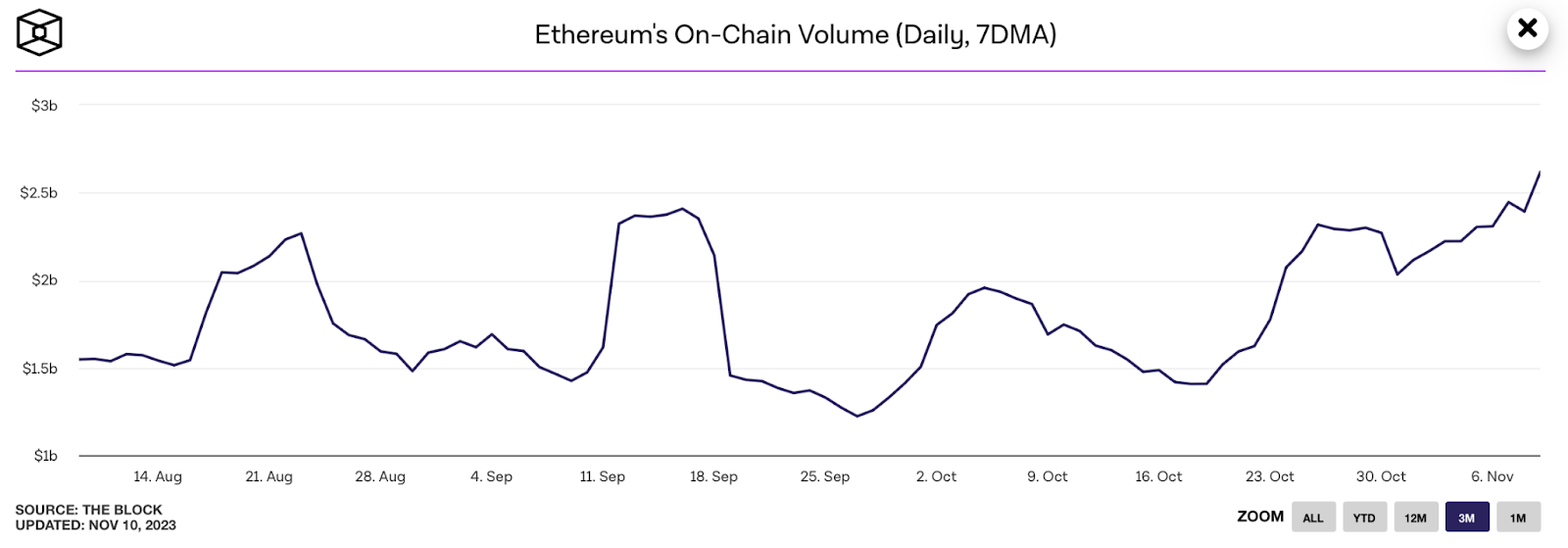

ETH on-chain quantity

On-chain quantity refers back to the whole worth of transactions performed on the Ethereum blockchain. In September 2023, Ethereum’s on-chain quantity was round 1.5 billion, which has elevated to 2.62 billion as of Nov. 10.

This metric is essential because it signifies the extent of exercise and utilization of the Ethereum community. The next on-chain quantity typically suggests elevated adoption and utilization of the community for transactions.

Typically, a better on-chain quantity can signify heightened investor and consumer curiosity in Ethereum, which might positively affect its worth. As extra transactions happen, it implies a strong demand for ETH, probably resulting in an increase in its worth.

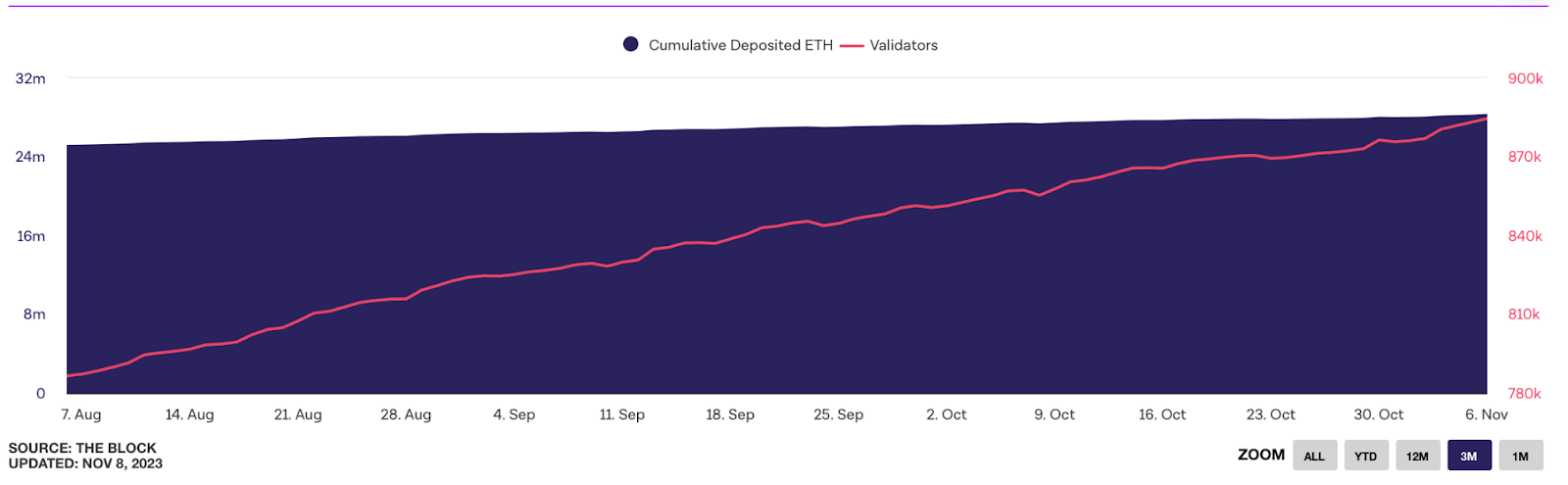

ETH deposited to the Beacon Chain

This refers back to the quantity of ETH staked within the Ethereum 2.0 Beacon Chain and the variety of validators taking part within the community. The staked ETH within the Beacon Chain elevated from 786,000 in August 2023 to 885,000 as of Nov. 10.

Depositing ETH into the Beacon Chain for staking is important for the safety and operation of the Ethereum 2.0 community. Extra staked ETH and validators imply a safer and decentralized community.

A rise in staked ETH and validators can enhance confidence in Ethereum’s long-term stability and exhibit a dedication from stakeholders to the community’s success, which is usually a bullish sign for buyers.

Ethereum (ETH) worth prediction

Whereas exploring Ethereum worth predictions, it’s essential to acknowledge the inherent uncertainties in such forecasts. These predictions are speculative and topic to market volatility.

An ETH worth prediction for Nov. 25 initiatives a worth of $2,199.93, exhibiting a 5.17% enhance. For December 2024, the ETH prediction is round $3,555.88.

An formidable ETH worth evaluation suggests Ethereum would possibly attain $4,487.64 in 2023 and probably $6,809.84 by 2025.

Bear in mind, cryptocurrency investments are dangerous, and market predictions could be inaccurate. By no means make investments greater than you may afford to lose, and think about searching for skilled monetary recommendation. Keep knowledgeable and cautious, particularly within the unstable crypto market.

Disclosure: This text doesn’t characterize funding recommendation. The content material and supplies featured on this web page are for instructional functions solely.

#analyzing #surge