Bitcoin value is at roughly $37,000, gaining greater than $10,000 during the last month. The BTCUSD chart is starting to look much more bullish. Nonetheless, essentially the most chart you’ll ever see is the highest cryptocurrency by market cap in contrast in opposition to the cash provide. Have a look.

The Most Bullish Bitcoin Chart Of All

Bears declare Bitcoin goes again to $10,000 because of the unfavorable macro surroundings. Extra but are sidelined, ready for nearer to the recurring “halving” earlier than they count on BTC to understand additional. However it’s attainable that bull market is brewing, and the aforementioned market individuals are in disbelief and affected by recency bias.

Much more bullish than the usual BTCUSD chart, is BTCUSD versus the M1 cash provide. In actual fact, it may probably counsel that Bitcoin is about to embark on its most vital bull run since 2017.

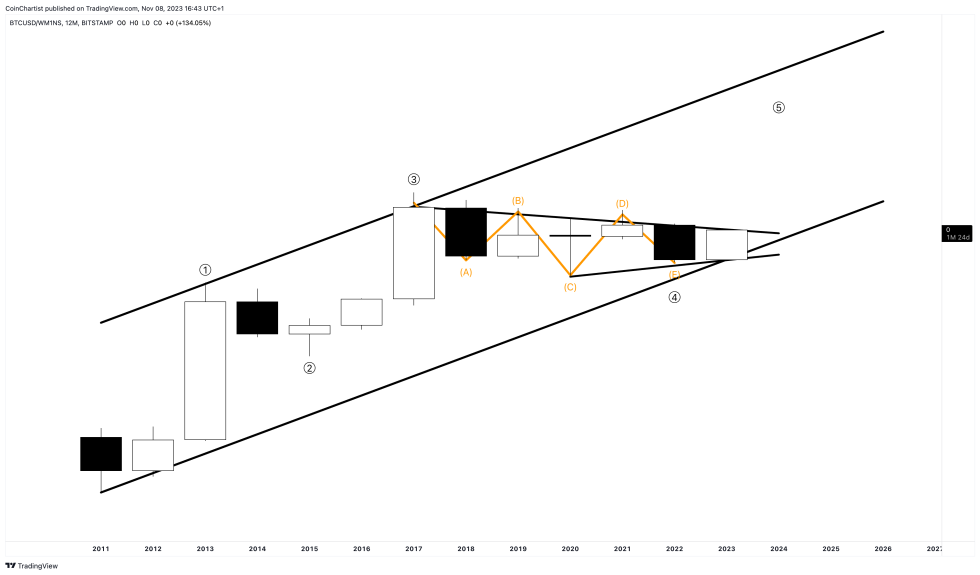

BTC versus M1 Cash Provide | BTCUSD on TradingView.com

The chart above depicts a long-term main uptrend channel starting in 2011. In contrast to the conventional Bitcoin chart in opposition to the US greenback, this ratio by no means made a brand new excessive after 2017. Towards the entire provide of cash (together with forex, demand deposits, and different liquid deposits), the highest cryptocurrency has been in a six-year bear market. Importantly, from a technical perspective, is the truth that the worth motion is contained inside a contracting triangle.

In accordance with Elliott Wave Precept, main traits transfer in 5 waves up. Odd numbers waves transfer within the main pattern path, whereas odd numbered waves right the pattern. Triangles waves sometimes seem within the wave 4 place, or wave B throughout a corrective part. Triangles themselves have to be counted with 5 waves, labeled ABCDE. The chart above exhibits that very same precise forwards and backwards buying and selling sequence, probably resulting in a thrust above the higher pattern line of the sample.

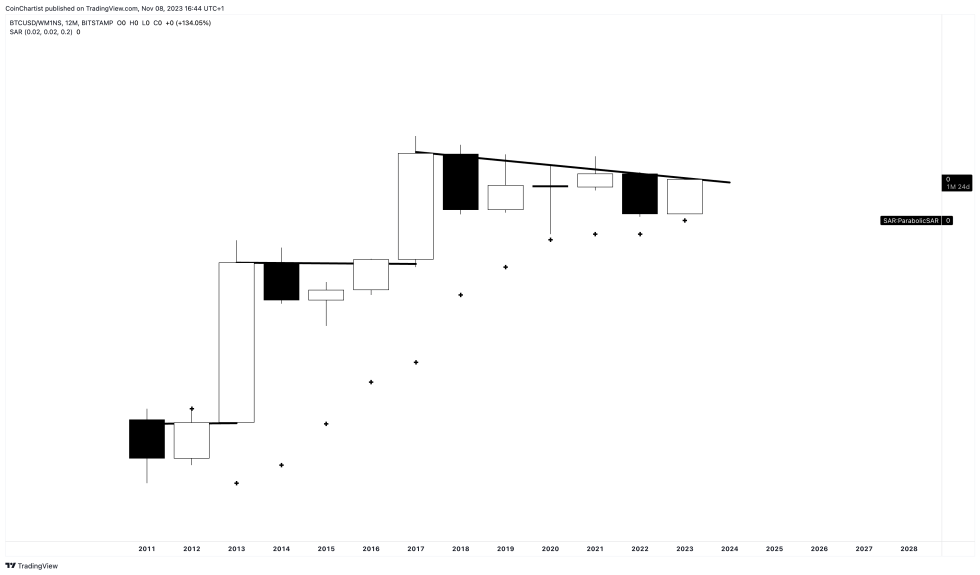

Parabolic SAR is supporting the uptrend | BTCUSD on TradingView.com

With the channel and wave counts eliminated, a breakout from a downtrend line seems imminent on the 12M Bitcoin versus M1 cash provide chart. This isn’t simply any Bitcoin chart, however the highest timeframe attainable. In technical evaluation, greater timeframes at all times have essentially the most significance. If the king of cryptocurrencies could make the next excessive above 2017, the worth of BTC in comparison with the provision of cash may skyrocket.

The Parabolic SAR additionally means that the ratio remains to be in a long-term uptrend, with value motion failing to tag the SAR throughout Black Thursday and the latest bear market in BTCUSD. And if the USD pair has already made two all-time highs with out a true breakout in opposition to the cash provide, what occurs to the usual BTCUSD chart as soon as the ratio in opposition to M1 breaks out?

S&P 500 versus M1 Cash Provide | SPX on TradingView.com

For comparability sake, this chart above is the S&P 500 in opposition to the identical M1 cash provide. In contrast to BTC, which made the next excessive for the reason that huge cash provide will increase round COVID, the inventory market has sunk to all-time lows in opposition to M1. This may very well be the place Bitcoin’s restricted 21 million BTC provide comes into play. As the cash provide will increase, the provision of BTC tends to scale back, or no less than stays the identical.

All three charts initially appeared in Subject #26 of CoinChartist VIP, entitled “Not Bullish Sufficient”. Subscribe without spending a dime or improve to premium to view the complete report. Entry CoinChartist VIP for 20% off for a restricted time with the Bull Market coupon code: Bullish

#Bitcoin #Cash #Provide #Bullish #Chart