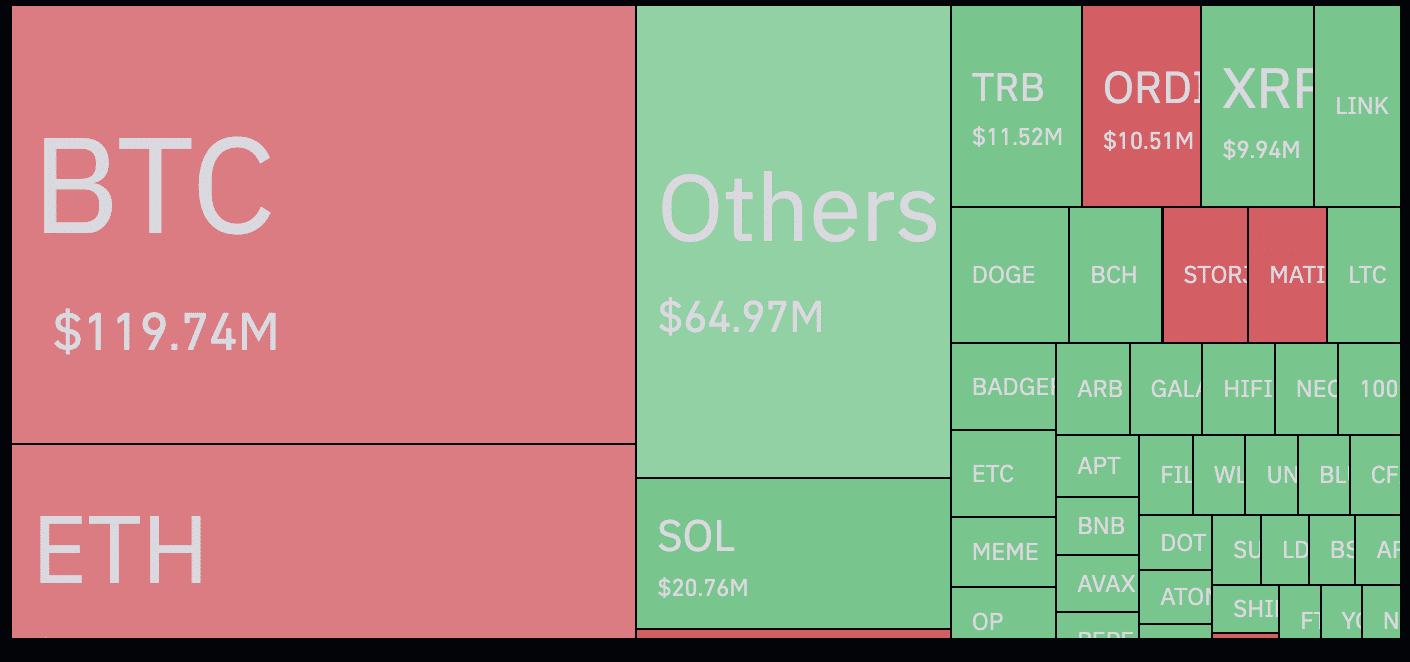

The whole quantity of liquidations on the crypto market over the previous 24 hours approached $440 million. Many of the pressured closed positions had been in BTC and ETH.

The rise in BTC value in direction of $38,000 price brief sellers $78 million. Market contributors who opened brief positions in Ethereum (ETH) additionally suffered important losses as a result of leap within the value of the second largest cryptocurrency by capitalization to the $2,000 mark, shedding $52.7 million.

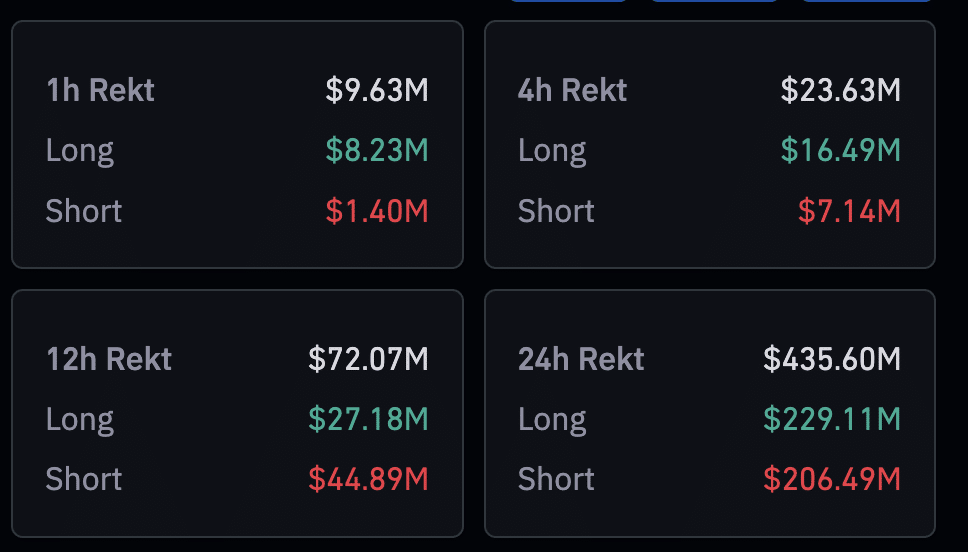

Up to now 24 hours, 148,093 merchants had been liquidated, the entire liquidations is available in at $435.6 million. Greater than 90% of the liquidations had been distributed amongst OKX, Bybit, Binance, and Huobi.

The biggest order was executed by OKX. The change closed a protracted BTC/USDT within the quantity of $14.76 million.

Yesterday night, the value of BTC renewed its annual excessive, approaching $38,000. On the time of writing, the principle cryptocurrency is buying and selling at $36,500.

The sharp improve started in opposition to the backdrop of one other wave of hypothesis surrounding the approval of purposes for a spot Bitcoin ETF by the US Securities and Change Fee (SEC).

On Nov. 9, 2023, the Nasdaq change additionally filed an utility to register the iShares Ethereum Belief with the US Securities and Change Fee.

#Bitcoins #surge #annual #excessive #price #merchants #440m