Mert Mumtaz, CEO of Helius Labs, a outstanding participant within the SOL ecosystem, just lately shared his ideas on the continuing comparability between Ethereum and Solana, two main Layer 1 (L1) blockchains. By a sequence of posts on X (previously Twitter), Mumtaz outlined a number of efficiency points the place Solana has proven superiority.

Solana Vs. Ethereum

Mumtaz begins out by explaining; “Spot the asymmetry: Solana has exceeded 700 person TPS often prior to now week — Ethereum does 12 TPS. That’s a 60x distinction.” He additional emphasised the numerous disparity in transaction finality speeds, with SOL attaining roughly 400 milliseconds in comparison with Ethereum’s roughly quarter-hour. This represents a 2,250x distinction.

Furthermore, he identified the stark distinction in common transaction charges, the place Solana averages $0.00025, considerably decrease than Ethereum’s vary of $1.5 to $20. Concerning community dimension, Mumtaz talked about, “Solana has ~3k nodes — Ethereum has round 8k nodes. That’s a 2.6x distinction.”

Mumtaz acknowledged Ethereum’s larger stage of decentralization however questioned the sensible affect of this distinction past a sure threshold. He additionally remarked on the significance of balancing decentralization with efficiency and accessibility, suggesting that excessive skewing in the direction of one side may not be splendid.

“This isn’t a dunk on Eth […] Each Ethereum and Solana are decentralized. Ethereum is extra decentralized, sure, however how a lot of a distinction does that make previous a sure threshold? On the finish of the day, you want to have the ability to construct low-cost, quick, scalable apps,” Mumtaz elaborated.

Mumtaz additionally speculated on the way forward for crypto exercise, suggesting that even in an optimistic state of affairs, a mix of SOL with L2s may be the best answer: “So if you happen to assume a very optimistic future for crypto exercise such that it pushes past the bounds of a single L1 with Moore’s legislation or all L2s mixed, then the best answer would nonetheless approximate one thing like Solana + L2s.”

Joe McCann, CEO and CIO of Uneven, additional contributed to the dialogue by highlighting knowledge from Galaxy Digital that emphasizes Solana’s rising prominence within the decentralized finance (DeFi) sector. McCann identified, “The variety of Solana DeFi customers interacting with 10+ good contracts (applications) each day is at a year-to-date excessive, representing 1.15% of all lively DeFi addresses.”

This statistic locations SOL considerably forward of Ethereum and different Layer 1 options when it comes to each day lively DeFi interactions. He famous that this represents an 11.5x enhance over Ethereum and even better multiples over different rivals: 6.88x greater than Optimism, 16.4x greater than Arbitrium and Avalanche, and greater than 23x greater than Polygon.

Cathie Wooden Acknowledges SOL

In a latest interview with CNBC Squawk Field, outstanding investor Cathie Wooden mentioned the evolving panorama of blockchain infrastructure. Whereas acknowledging Ethereum’s standing because the main good contract and decentralized finance community, Wooden additionally acknowledged SOL’s rising significance.

Associated Studying: FTX Chapter Is Now One-Yr Previous – How Has Solana (SOL) Fared Since Then?

Wooden defined, “Solana is doing a extremely good job. I imply, if you happen to have a look at Ether, it was quicker and cheaper than Bitcoin again within the day. That’s how we obtained Ether. Solana is even quicker and cost-effective than Ether.”

She emphasised the significance of infrastructure performs within the blockchain area, hinting at SOL’s potential function within the improvement of Web3 and digital belongings, together with the implementation of on-line property rights.

Her feedback replicate a broader trade perspective that, whereas Ethereum presently holds a dominant place, Solana is gaining traction attributable to their enhanced efficiency traits and value effectivity.

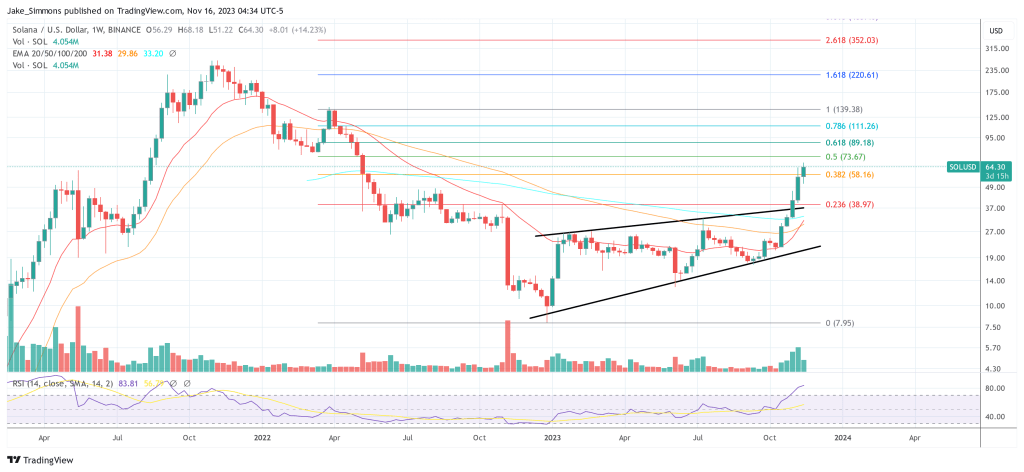

At press time, SOL traded at $64.30.

Featured picture from WoolyPooly, chart from TradingView.com

#Helius #CEO #Outlines #SOL #Superior