The newest pattern within the Bitcoin taker buy-sell ratio might counsel a bearish reversal could also be coming quickly for the cryptocurrency.

Bitcoin Taker Purchase Promote Ratio 100-Day EMA Has Encountered Resistance

An analyst in a CryptoQuant Quicktake put up defined that the asset could also be heading in direction of a correction as a result of taker buy-sell ratio coming throughout robust resistance. The “taker purchase promote ratio” is an indicator that retains observe of the ratio between the Bitcoin taker purchase and taker promote volumes.

When the worth of this metric is bigger than 1, it signifies that the taker purchase or the lengthy quantity is bigger than the promote quantity proper now. Such a pattern implies that almost all shares a bullish sentiment because the buyers are keen to pay the next worth for the asset.

Alternatively, values underneath the brink counsel the dominance of a bearish mentality within the sector, because the promoting strain is bigger than the present shopping for strain.

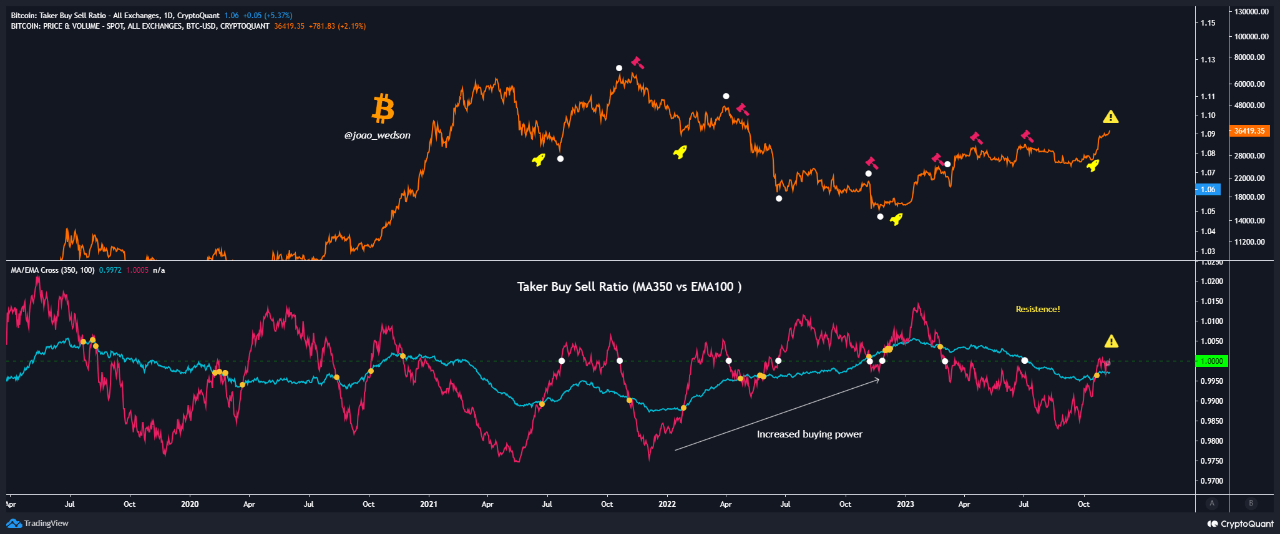

Now, here’s a chart that exhibits the pattern within the 350-day transferring common (MA) and 100-day exponential MA (EMA) of the Bitcoin taker buy-sell ratio over the previous few years:

Appears to be like like the 2 metrics have crossed one another lately | Supply: CryptoQuant

Within the graph, the quant has highlighted an fascinating sample that has repeated for these two averages of the Bitcoin taker buy-sell ratio through the years. It will seem that every time the 100-day EMA has crossed above the 350-day MA, the cryptocurrency’s worth has gone on to look at bullish momentum shortly.

Alternatively, the other sort of cross has normally been a bearish predictor for the asset. Moreover these two crossovers, the interplay of the 100-day EMA with the 1-mark has additionally been related to the coin.

The road crossing above the 1-mark, which serves because the boundary between the bullish and bearish sentiment areas, has usually meant a reversal for the cryptocurrency.

From the chart, it’s seen the bullish sort of crossover occurred between the 100-day EMA and 350-day MA of the Bitcoin taker purchase promote ratio only recently, and what has adopted to date has been a pointy rally for the asset that has now taken it to the $37,000 stage.

The 100-day EMA initially continued its rise after the cross above the 350-day MA, however the line has stopped across the 1-level, implying that it has been discovering resistance.

A break above right here would have naturally been one other bullish sign for Bitcoin, however as the road has been unable to transcend to date, rejection may happen as a substitute. If such a sample types, the asset may see a bearish reversal within the coming days.

BTC Worth

As soon as once more, Bitcoin is difficult the $37,000 stage after dipping under it in the course of the previous day.

BTC has noticed additional uplift in the previous few days | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, charts from TradingView.com, CryptoQuant.com

#Bearish #Reversal #Coming #Bitcoin #Metric #Warn