A latest K33 Analysis report signifies a big uptick in institutional funding in Bitcoin by means of exchange-traded merchandise, coinciding with key deadlines for the SEC’s determination on Bitcoin spot ETFs, presenting a posh panorama of market optimism and warning.

In a latest evaluation, K33 Analysis highlights a big surge in institutional curiosity in Bitcoin (BTC), notably by means of exchange-traded merchandise (ETPs). This development, marked by a rise of 27,095 BTC, surpasses the expansion seen within the months following BlackRock’s submitting for a Bitcoin spot ETF.

The report by K33 Analysis, led by Senior Analyst Vetle Lunde and Vice President Anders Helseth, factors to a sturdy institutional demand for Bitcoin, evidenced by sustained excessive publicity on the CME (Chicago Mercantile Trade). This development coincides with impending deadlines for the approval of bitcoin spot ETFs by the U.S. Securities and Trade Fee (SEC).

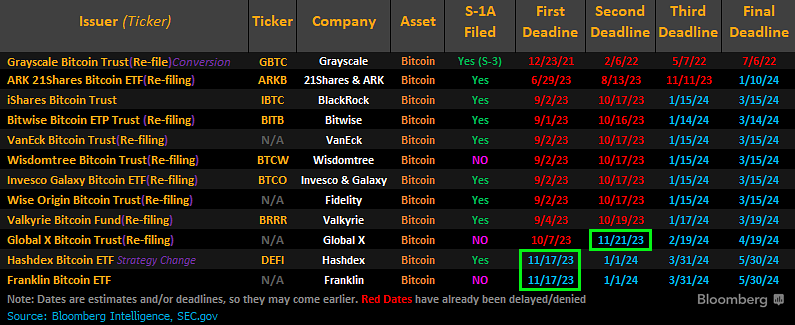

The highlight is on two particular purposes from Hashdex and Franklin, with a choice deadline set for Nov. 17. The analysts notice that this window gives a chance for the SEC to approve all present purposes concurrently, which might be a big second for the market. Nevertheless, a failure to take action would shift focus to the subsequent vital deadline on Jan. 10, doubtlessly slowing market momentum.

Whereas CME merchants exhibit a bullish outlook, with Bitcoin futures premiums constantly excessive and open curiosity reaching new heights, making CME the world’s largest Bitcoin derivatives alternate, this sentiment shouldn’t be universally shared. Crypto-native merchants show a extra cautious stance.

The report notes that the latest Bitcoin rally appears to be pushed extra by warning from quick sellers than outright optimism. This cautious method, alongside rising open curiosity, usually precedes lengthy liquidations.

Certainly, this warning was underscored by a big liquidation occasion, the most important since August, the place $89.5 million in lengthy Bitcoin positions had been liquidated throughout numerous exchanges. The occasion serves as a reminder of the volatility and threat inherent in cryptocurrency markets.

#K33 #Analysis #finds #institutional #Bitcoin #funding #surge #pending #ETF #choices