Grayscale CEO Michael Sonnenshein mentioned his agency has not acquired any phrase about approval for spot Bitcoin ETFs from the Securities and Change Fee (SEC) main as much as a window the place all 12 purposes may obtain the inexperienced mild.

The SEC has not disclosed when it’d authorize issuers like BlackRock and ARK Make investments to record exchange-traded funds (ETFs) that supply direct publicity to identify Bitcoin costs, mentioned Sonnenshein on Nov. 8. Grayscale’s boss added that the agency may litigate if the SEC rejects its utility.

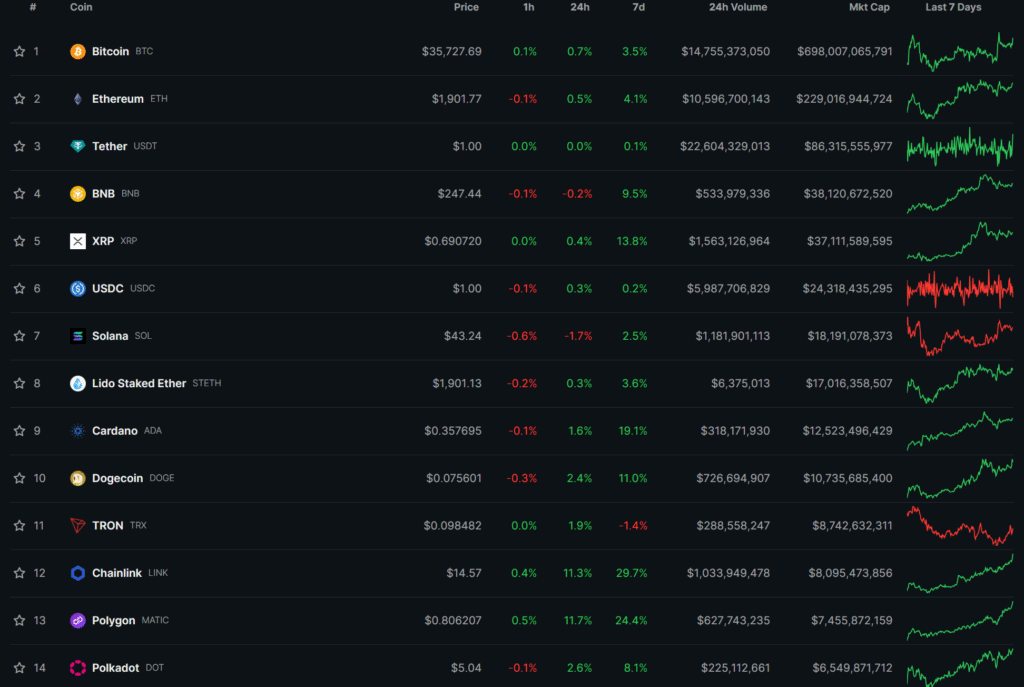

Sonnenshein shared these remarks throughout the seventh Annual D.C. Fintech Week amid rallying crypto token costs and expectations surrounding a forthcoming SEC nod for spot Bitcoin ETFs. Cryptocurrencies like ADA, LINK, Polygon and XRP have seen double-digit positive factors inside every week as Bitcoin sat above $35,000.

Though nobody can say for certain when the SEC may difficulty approvals for any of the 12 bids at present in overview, ETF specialists opined that the chances favor a choice to deliver spot Bitcoin ETFs to market by Jan. 10.

Bloomberg analysts Eric Balchunas and James Seyffart every mentioned {that a} window has occurred for the securities watchdog to greenlight all purposes on its desk, together with Grayscale’s GBTC conversion, and this timeframe can be open for eight days between Nov. 8 and Nov. 17.

Balchunas additionally pointed to instructional content material revealed by the SEC that will additional strengthen hopes of approval sooner somewhat than later. The fee launched comparable supplies in October 2021 shortly earlier than sanctioning a Bitcoin futures ETF issued by ProShares.

#SEC #approval #timeline #Grayscale #CEO #spot #Bitcoin #ETFs