Crypto analyst Jacob Canfield has laid out a complete evaluation, suggesting Solana (SOL) may very well be getting ready to an unprecedented market surge. “For my part, I feel that Solana goes to proceed to be one of many largest movers throughout this present bull market cycle,” Canfield states, proposing that Solana may probably escalate its market dominance to the 12-15% vary.

Can Solana Hit $1,000?

Canfield bases his evaluation on a number of indicators. He highlights the Solana Dominance (SOL.D) chart, noting that on the peak market cap, it didn’t even crack 3%. Given the present developments and the breakout of SOLBTC from its weekly resistance, Canfield envisions a situation the place Solana may enter a parabolic rally part, which is additional supported by the SOLETH chart exhibiting an identical sample. “SOLETH – Additionally at the moment broke out of a weekly resistance and appears to be forming a parabolic rally in opposition to it.”

A major consider Canfield’s evaluation is the present state of Ethereum Dominance (ETH.D). He notes that ETH.D is breaking down from a long-term trendline and dropping the 200 weekly shifting common, now sitting at 17%. “If Solana continues to pattern in opposition to Ethereum and it continues to interrupt right down to 2019-2020 ranges, we may see SOL as the large winner this cycle,” Canfield explains.

Nevertheless, Canfield doesn’t disregard the potential ramifications of current information relating to an Ethereum ETF. “This may occasionally not play out with the present ETF announcement information as it’ll carry extra consideration,” he acknowledges, indicating that an accredited Ethereum ETF may shift investor focus and capital again to Ethereum, probably tempering Solana’s ascent.

Regardless of potential headwinds from the Ethereum sector, Canfield emphasizes Solana’s strong partnerships with company giants like Google, Circle, and Amazon, positing that these collaborations may considerably drive adoption and improve Solana’s visibility on this cycle of the crypto market.

Moreover, Canfield’s evaluation extends past charts and partnerships. He delves into the Solana ecosystem, spotlighting initiatives which can be paving the best way for its growth. From decentralized finance protocols and automatic market makers to NFT storage options and governance tokens for gaming platforms, Canfield factors to a breadth of innovation inside Solana that parallels, and in some elements, seeks to outdo Ethereum’s ecosystem.

In gentle of the FTX debacle, Canfield remarks on the psychological affect on Solana’s market sentiment, noting that with Sam Bankman-Fried’s authorized troubles, there is a chance for Solana to redefine itself. “There’s a little bit of PTSD across the ecosystem, but it surely’s time to turn into its personal entity and forge its personal future,” he asserts, suggesting that Solana’s future will probably be formed by those that are deeply built-in into its ecosystem, from builders to merchants and influencers.

His conclusion: “Solana may triple or quadruple it’s all time excessive market dominance round 12-15% and if it continues to pattern in opposition to Bitcoin, may simply see a $1,000 per coin and take the #2 spot behind Bitcoin.” When requested concerning the potential of Ethereum, Canfield emphasised, “No motive to not have allocations to each. It’s like attempting to guess on Microsoft or Google. Tesla or Ford: Simply purchase each.”

Quick-Time period SOL Value Outlook

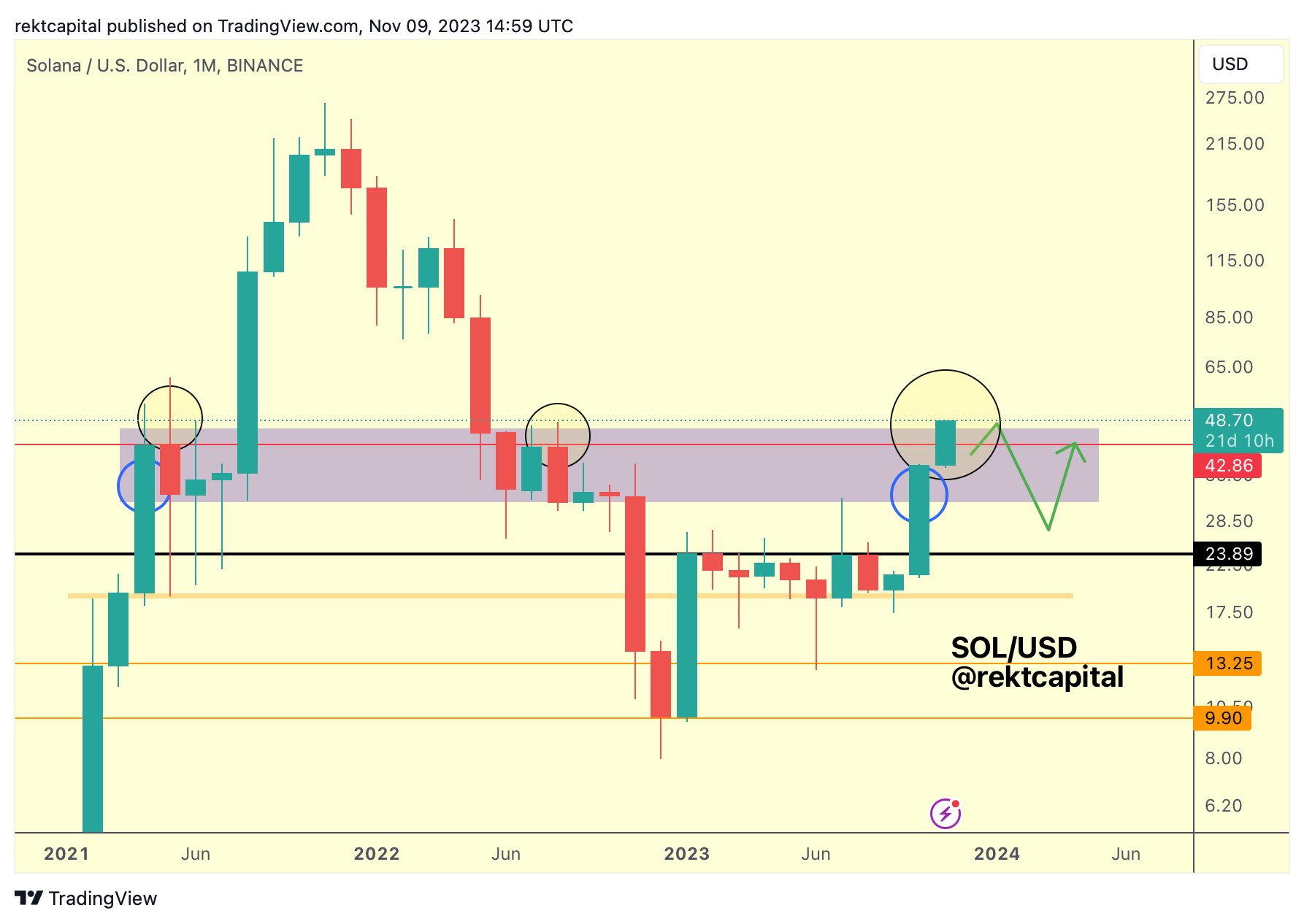

On the shorter-term horizon, analyst Rekt Capital brings consideration to Solana’s value actions in a current submit on X. “Solana continues to outperform available in the market. In 2021, SOL upside deviated to $53 after which $61 earlier than retracing to the underside of the purple field,” he famous, referring to a particular zone on the worth chart that has traditionally acted as each resistance and assist.

Within the Rekt Capital chart, SOL is at the moment breaking out above the zone. Nevertheless, if historical past repeats itself and the zone as soon as once more acts as sturdy resistance, the SOL value may endure a extreme pullback. Utilizing the inexperienced arrow within the chart, Rekt Capital paints a situation by which SOL initially falls again in the direction of $30 earlier than the worth rises once more in the direction of $42.

Featured picture from ABCC Change, chart from TradingView.com

#Solana #Value #Attain #Analyst #Explains