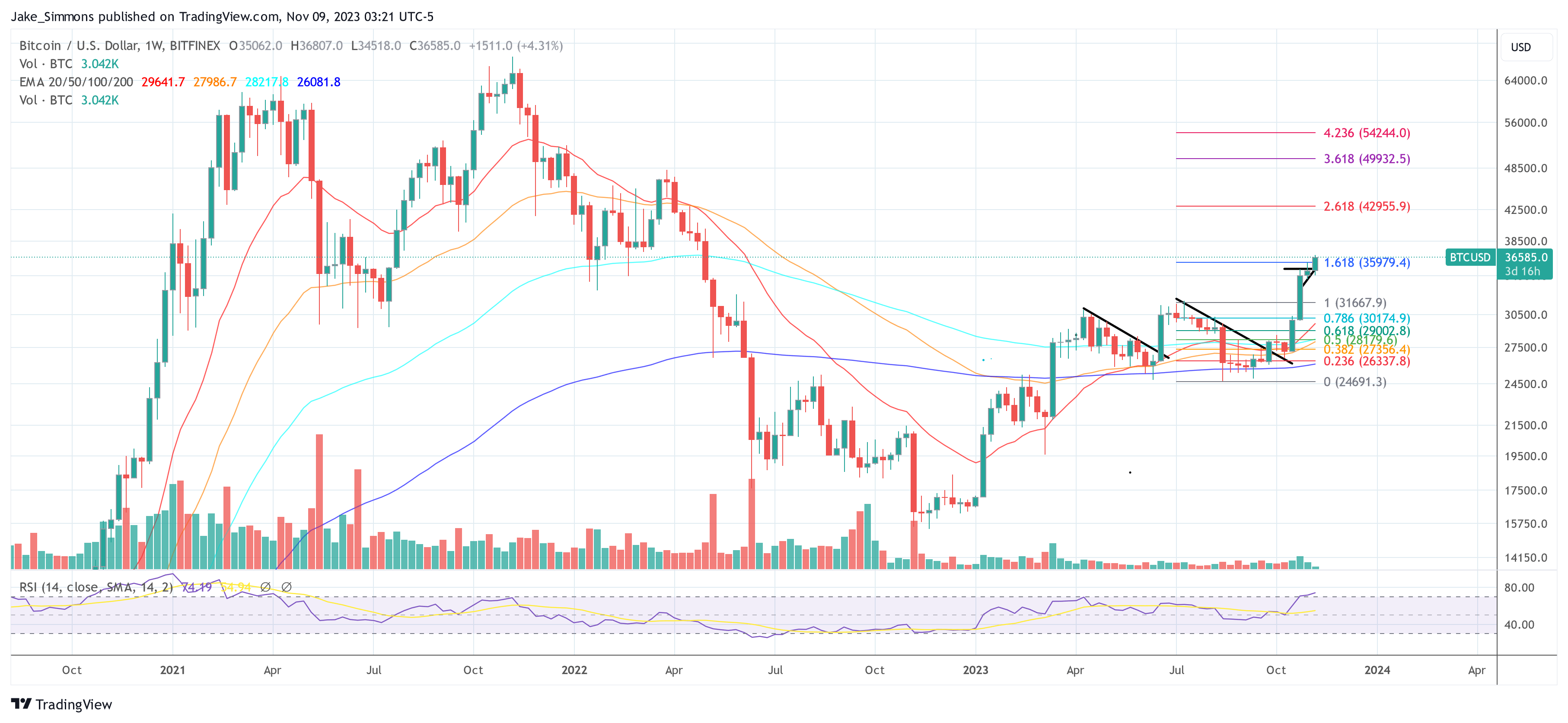

The Bitcoin worth has seen a big improve of greater than 4% throughout the final 24 hours. The value has risen to $36,800. A number of key components have contributed to this rally.

#1 Spot Bitcoin ETF Buzz

The surge in BTC’s worth may be attributed to renewed speculations in regards to the potential approval of a spot Bitcoin exchange-traded fund (ETF) by the US Securities and Alternate Fee (SEC). Yesterday, Bloomberg’s James Seyffart put out a brand new notice, highlighting that the SEC is in a novel place throughout the subsequent eight days the place they may approve all 12 spot ETF purposes, as Bitcoinist reported.

Seyffart additional identified that the SEC has the chance to approve 9 purposes (excluding International X Bitcoin Belief, Hashdex Bitcoin ETF, and Franklin Bitcoin ETF) at any level till January 10, 2024. Bloomberg’s Seyffart and Eric Balchunas nonetheless estimate a 90% probability of approval for not less than among the pending purposes earlier than January 10, 2024.

The ETF buzz was additional fueled by information that Grayscale is in energetic discussions with the SEC concerning the conversion of its GBTC belief right into a spot ETF. Grayscale’s current courtroom victory over the SEC on August 29 has added to the anticipation.

#2 Bitcoin Whales

There was a notable improve in actions by Bitcoin whales, which may be interpreted as an indication of market optimism. Crypto analyst MartyParty identified a sample of considerable purchases, with a whale reportedly shopping for $15 million of BTC each three hours, suggesting anticipation of constructive developments within the ETF entrance.

Keith Alan from Firecharts noticed that Bitcoin whales are actively shifting liquidity available in the market, with noticeable adjustments in bid ranges. He acknowledged, “FireCarts reveals BTC whales persevering with to maneuver liquidity across the order ebook. Bids that have been moved all the way down to $34k earlier have now returned to the $34.5k degree.”

Moreover, a rise in TWAP (Time-Weighted Common Value) shopping for on Coinbase has been reported. Crypto analyst Exitpump famous, “BTC Spot Delta: Somebody on Coinbase twapping / market shopping for.” TWAP shopping for is a buying and selling technique utilized by large gamers to execute massive orders in a method that goals to attenuate worth affect and obtain a median execution worth near the market common over a specified time interval.

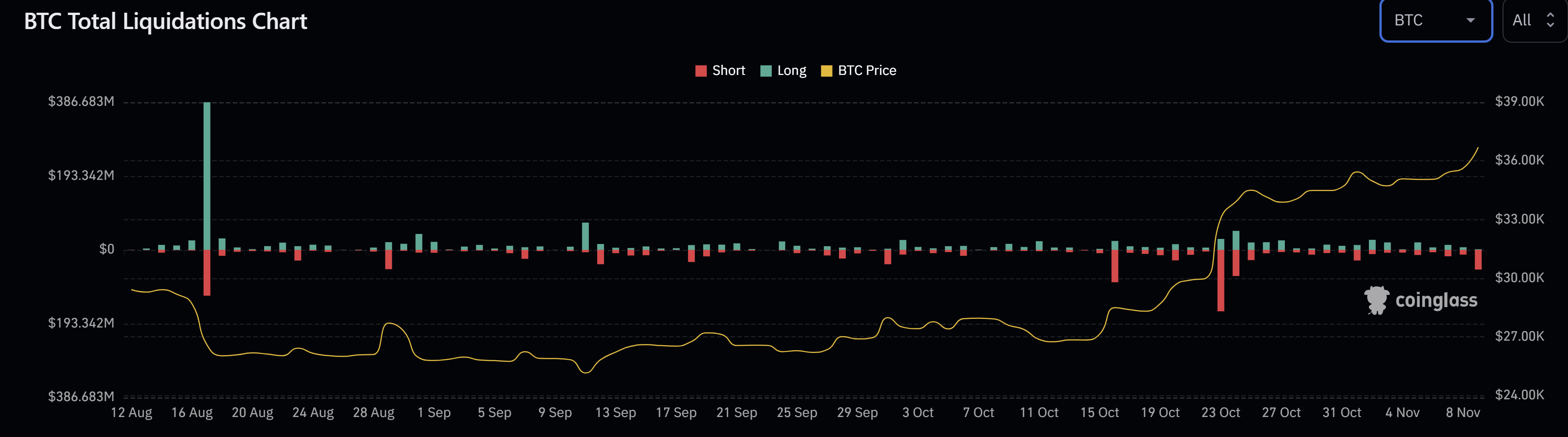

#3 Quick Squeeze

The Bitcoin market has additionally skilled a big quick squeeze, with roughly $51 million in BTC quick positions being liquidated as we speak (in keeping with Coinglass knowledge, as of press time). This quantity marks the most important quick squeeze since October 23 and 24, when $161 million and $68.5 million in Bitcoin quick positions have been liquidated on consecutive days, resulting in a considerable worth improve of greater than 18%. Immediately’s quick squeeze actually caught some merchants on the mistaken foot who believed that $36,000 – the earlier vary excessive – was a “secure” quick commerce.

#4 Bitcoin Provide Dynamics

The availability of Bitcoin on exchanges has been steadily lowering, reaching a six-year low on the finish of October. Daan Crypto Trades, a famous crypto dealer, highlighted the downward pattern in Bitcoin inflows to exchanges. He remarked:

Bitcoin Alternate inflows have been trending down on the upper timeframe. In comparison with for 2021-2022 there’s a transparent pattern down in BTC inflows to exchanges. Would count on that to begin ticking again up as soon as the bull market actually will get going and other people begin taking income.

Moreover, on-chain knowledge reveals {that a} important 76% of the Bitcoin provide is at the moment held by long-term holders, who haven’t moved their cash for over 155 days. Analyst Dylan LeClair emphasised the power of hodlers, noting {that a} staggering 88.5% of the availability has remained static during the last three months.

“The hilarious factor is that 88.5% of the Bitcoin provide hasn’t moved within the final three months. Wall Road is gonna have to actually pump this factor to get hodlers to half with their cash,” LeClair acknowledged.

At press time, BTC traded at $36,585.

Featured picture from Shutterstock, chart from TradingView.com

#Bitcoin #Value #Soar #Heres